Diversified Revenue + Funding

Building long-term sustainability for mission-driven organizations

Closing the Philanthropic Gap

Our society faces increasingly complex social and economic issues that cannot be properly addressed through government and philanthropic funding alone. The cost to address chronic social problems, from poverty, to environmental sustainability, to public health, far exceeds the available capital. Donations, though critical, are unsustainable ways to fund the services provided by mission-driven organizations.

Our Approach

Now more than ever, mission-driven organizations are recognizing the need to develop sustainable business models that withstand fluctuations in contributed capital, often caused by varying economic circumstances and funder priorities. Industry leaders are increasingly pursuing diversified revenue streams, including earned income, to improve funding predictability, autonomy, resiliency, and economic hedging. Sustainable revenue improves an organization’s financial resilience and self-sufficiency, which in turn, accelerates mission focus, innovation, growth, and ultimately, greater social impact. At the same time, donors and funders need to think beyond contributed capital to innovative tools including impact investing in order to close the “Philanthropic Gap.”

We believe the way organizations are funded dictates how they are operated. Impact investment capital provides additional asset classes to properly finance growth and scale while creating long-term relationships with investors.

Our Tools

Impact investing and social enterprise: Social enterprises are uniquely positioned to deliver innovative social change when provided with enterprise level investment. Social impact investors are doing just that; thinking beyond donations to close the “philanthropic gap” and investing in social enterprises or impact-focused funds, with the intent to create measurable social benefits alongside a financial return. investment opportunities.

Capacity grants to stabilize and grow organizations: Mission Throttle provides capacity grants to intermediary organizations that support and accelerate the impact investing ecosystem.

What is Impact Investing?

Impact investing is the placement of capital into businesses, organizations and funds with the intent to create measurable social or environmental benefits alongside a financial return.

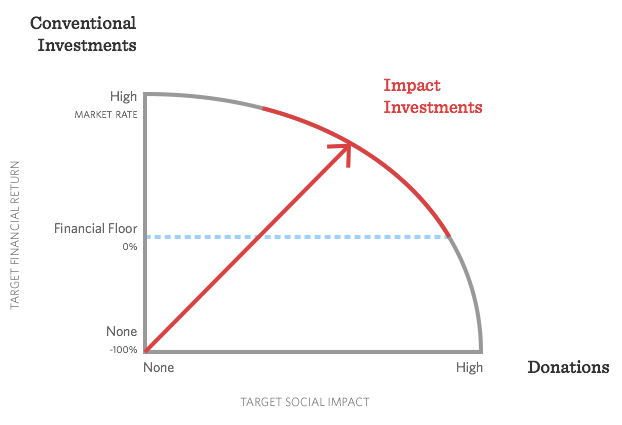

Traditionally, charitable donations and business investments are considered separate or even antithetical activities. Impact investing provides a third option for financing social impact between a 100% financial loss of a donation and a market rate return on a conventional investment. It seeks a blended return, the overall return achieved by combining an investment’s social impact with the financial return.

Who receives impact investments?

Social Enterprises, which are mission driven organizations (for-impact or for-profit) that use business strategies to generate sustainable social impact.

How do for-profit social enterprises deliver social impact?

Social enterprises provide critical goods and services directly addressing key social issues traditional businesses do not. Their performance is determined by measuring their financial, social and environmental impact, also known as the “Triple Bottom Line.”

How do for-impact social enterprises deliver financial return?

Social enterprises provide goods and services to paying customers in the same manner as traditional businesses. Earned income often accounts for a small portion of the total resources needed to cover expenses. Donations are raised to balance budgets, and impact investments supplement contributed income.

How do social enterprises use impact investing?

Program Related Investments (PRIs) are used by foundations for their potential to meet charitable purposes while generating financial returns. PRIs are tools such as low-interest loans or equity investments that provide opportunities for foundations to go beyond grantmaking to allocate a greater share of their resources to support and assist organizations and achieve the foundation’s philanthropic goals, while growing their assets. In turn, this allows foundations to recycle their funds and leverage them for greater impact. Private foundations must count PRIs as part of their annual minimum payout.

Is impact investing widespread? Who else is doing it?

Pioneering foundations, banks, fund managers and individuals are actively using impact investments to drive specific social outcomes aligned with their missions and values.

Do you think impact investing should be used instead of traditional funding methods?

Impact investments can be deployed alongside traditional investments and charitable donations to create sustainability and drive community impact. Impact investing offers a new tool for funding social impact while delivering financial returns.

How are SRI (Socially Responsible Investing) and ESG (Environmental, Social, Governance) Screening different from Impact Investing?

These terms are often used interchangeably, but have important differences. Socially responsible investing (SRI) entails screening investments to exclude businesses that conflict with the investor’s values. Environmental, social and corporate governance (ESG) investing focuses on companies making an active effort to either limit their negative societal impact or deliver benefits to society (or both). This article provides an in depth analysis of the differences between these terms.

For more information about impact investing, visit these comprehensive resources from our partners at Mission Investors Exchange and Global Impact Investing Network (GIIN).